An Investment Analyst is a key player in the financial world, influencing investment decisions that can shape entire markets. Their research and recommendations affect not only the portfolios of individual investors but also global economies. This article delves into the responsibilities of an investment analyst, their impact on financial markets, and the tools and skills they use to drive success.

Key Responsibilities of an Investment Analyst

At the heart of the investment analyst’s role is thorough market research. Analysts examine various sectors, assess economic trends, and review financial reports from companies to forecast future performance. Their ability to synthesize this data is critical in advising clients on investment opportunities.

Risk Assessment

Understanding and managing risk is a fundamental part of investment analysis. Analysts evaluate the potential risks associated with different investment options, considering factors such as market volatility, interest rates, and global economic conditions.

Portfolio Management Support

Investment analysts provide crucial support to portfolio managers by recommending changes to asset allocations based on market conditions. Their insights help maintain portfolio performance and ensure it aligns with clients’ investment goals.

How Investment Analysts Influence Financial Markets

The research and recommendations made by investment analysts can have a significant impact on stock prices. Positive analyst ratings or upgrades on a particular stock can lead to increased buying activity, while downgrades can result in selling pressure, impacting market sentiment.

Role in Economic Forecasting

Investment analysts also play a role in shaping broader economic forecasts. Their reports are often used by policymakers, companies, and investors to gauge economic health, predict market trends, and adjust strategies accordingly.

Driving Investment Trends

Investment analysts often help shape investment trends, such as the growing focus on Environmental, Social, and Governance (ESG) investing. Their analysis can highlight opportunities in emerging sectors like renewable energy, driving more capital towards sustainable and socially responsible investments.

Tools and Resources Used by Investment Analysts

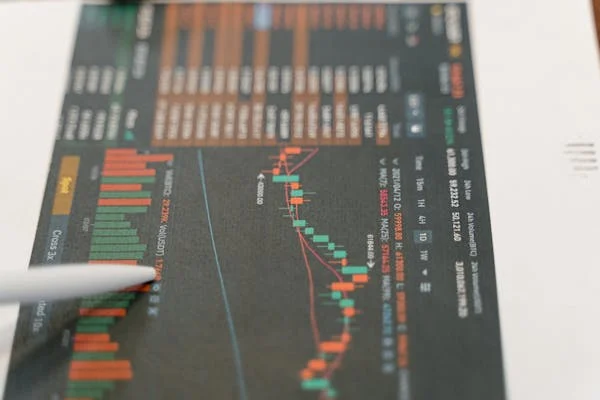

Investment analysts rely heavily on financial modeling to predict the future performance of companies or assets. These models incorporate various financial metrics, such as revenue growth, profit margins, and cash flow, to create forecasts that guide investment decisions.

Data Platforms

Tools like Bloomberg Terminal, Morningstar, and Reuters Eikon provide real-time access to financial data, news, and market analysis. These platforms are essential for staying updated on market movements and making informed recommendations.

Software and Analytics Tools

Advanced software, including statistical programs and machine learning algorithms, is increasingly used to automate data analysis and generate investment insights. These tools help analysts process large volumes of data quickly and efficiently.

Skills that Define a Successful Investment Analyst

A deep understanding of financial markets, instruments, and economic principles is fundamental to an investment analyst’s success. They must be able to evaluate companies, industries, and economies to determine which investments will provide the best returns.

Critical Thinking and Problem Solving

Investment analysts often deal with complex problems, such as how to maximize returns while minimizing risk. The ability to think critically and develop innovative solutions is key to making informed investment recommendations.

Time Management and Efficiency

The financial world moves quickly, and investment analysts must manage their time efficiently to keep up with market developments. Time-sensitive decisions require quick, accurate assessments of financial data, making time management a vital skill.

Career Path of an Investment Analyst

Many aspiring investment analysts start their careers in entry-level positions such as research assistants or financial analysts. These roles provide valuable experience in data analysis, report writing, and financial modeling.

Senior Investment Analyst

As analysts gain experience, they may move into senior roles where they oversee larger portfolios, make independent investment recommendations, and mentor junior analysts. At this level, analysts have more direct influence over client investment strategies.

Moving to Investment Management

After several years of experience, successful analysts may transition into portfolio management roles. Here, they take on greater responsibility for asset allocation, risk management, and performance tracking for institutional or private clients.

Conclusion

Investment analysts play a critical role in shaping financial markets through their research, risk assessments, and investment recommendations. By using advanced tools, critical thinking, and strong financial knowledge, they help investors make informed decisions. As the financial landscape evolves, investment analysts will continue to be key players in guiding both individual and institutional investments.